By Rachel Lynn Foley, Esq.

January 10, 2012

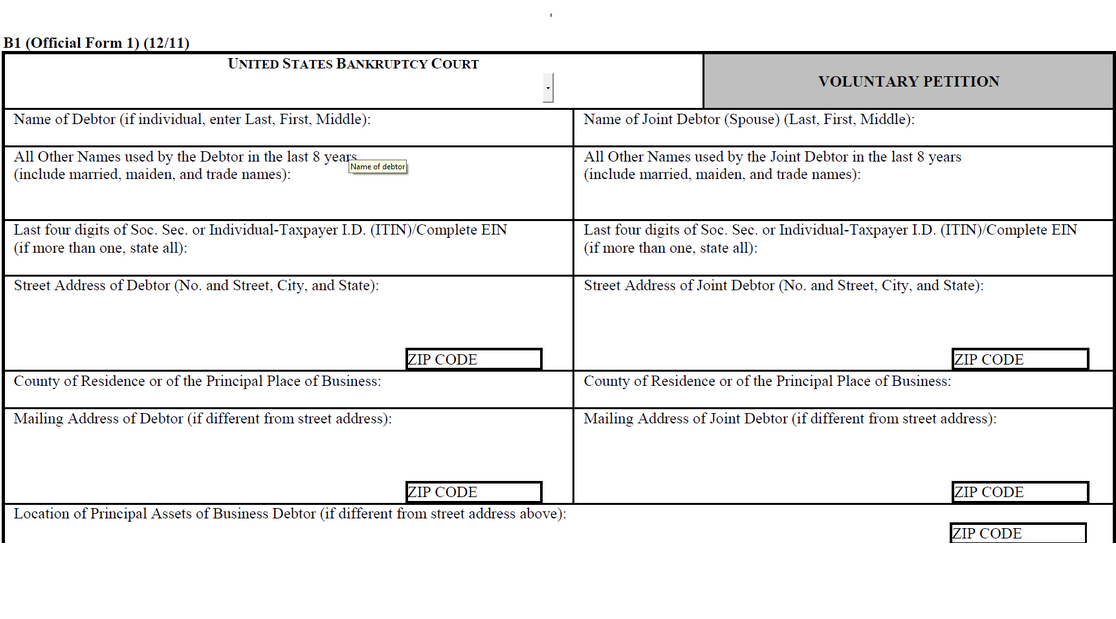

Bankruptcy Voluntary Petition

When you file a bankruptcy...

regardless of the chapter, you must file what’s called apetition. The petition is a three page document filed with the bankruptcy court requesting specific relief. Meaning you are asking the court for relief through a Chapter 7, 9, 11, 12, 13 or 15 bankruptcy. You MUST actually sign this document. If your attorney has filed a case and you have NOT actually signed this document, your case can be dismissed.

On the first page of the petition you will need to list your full legal name. This means your first, middle and last name. If you do not legally have a middle name you will use the initials, NMI. NMI means no middle name. You will also need to list all names that you have used in the past. Why? Because you want the creditors to update their records under any and all names that your accounts maybe listed under. Although creditors generally list the accounts under social security numbers but this is not always the case. Therefore be sure and give your attorney all your names.

The Type of Debtor section will identify if the filing is a human, corporation, partnership or other such as a municipality. The Nature of Business will be identified if your business is filing bankruptcy. You will also identify what type of Chapter you are filing such as a Chapter 7, 9, 11, 12, 13 or 15. If you are a business you will need to identify whether your business has a tax exempt status Then you need to identify the Nature of the Debts. Are the debts business or personal?

This is a critical identification part because if your debts are 51% or more as business debts then you do not need to perform the means test. In some cases this will mean the difference between qualifying for a Chapter 7 and not.

The filing fee needs to be identified as being filed with the court or requesting to pay the fee installments or having the fee waived altogether.

If you are filing a Chapter 11 you will to do identify yourself as a small business or not a small business.

The last section of the first page is the statistical information section. The court needs you to identify whether or not you have money to pay your creditors. Then how many creditors do you have in your case. The worth of your assets and amount of your liabilities also needs to be identified. This area allows a quick glance at your financial situation.

The second page of the petition identifies all the prior bankruptcies you have filed. Although it only asks for the last 8 years, I have my clients identify all bankruptcies that have been filed in their lifetime. Why? Because this is the beginning of the process to have them think outside the box. You will also need to list any pending bankruptcies filed by a spouse, partner or affiliate. This is critical because the information in both bankruptcies should somewhat mirror each other. If there is a large discrepancy this might be a red flag for fraud.

If you are required to make reports under the Securities and Exchange Commission you will need to fill out Exhibit A. If you do not know what this means, then it probably does not apply to you.

Exhibit B is where the attorney signs off stating that they have reviewed your case and that you are eligible to file bankruptcy.

Exhibit C is used to identify any property that may pose a threat of imminent and identifiable harm to public health or safety. This may be occur if an ammo dealer files for bankruptcy or if a farmer with large amounts of chemicals on hand files for bankruptcy relief. Generally the average debtor does not posses anything that would cause a threat of imminent and identifiable harm to the public. However, if you do poses something that might qualify be sure to tell your attorney.

Exhibit D identifies whether or not you have taken credit counseling as required within 180 days. Keep in mind if you have not taken and finalized a credit counseling session within 180 days prior to filing bankruptcy you do not qualify to file bankruptcy unless your case qualifies under one of the exceptions to the credit counseling requirement.

Moving on to the next section you must identify that you have proper venue. This means that you have to live within the area of the court for at least the last 91 days before filing your bankruptcy case.

If you are renter you must fill out the information in the Certification by a Debtor Who Reside as a Tenant of Residential Property. This section needs to be filled out if you are behind in your rent. You will also need to deposit with the court any rent that becomes due within 30 days after filing bankruptcy.

Page 3 of the petition is where you signing under penalty of perjury that everything contained in the petition is true and correct. The attorney will also sign on this page indicating that your schedules are correct. The attorney’s signature also indicates that they have met you and reviewed your case personally. If you have filed a business bankruptcy you will sign under the Corporation/Partnership section. If you have filed a Chapter 15 you will sign under the Signature of a Foreign Representative section. If someone has assisted you with this bankruptcy the petition preparer MUST sign under the Signature of Non-Attorney Bankruptcy Petition Preparer.

The petition is a critical document that must be filed out correctly and have a wet signature. A wet signature means that you must actually sign the document and the attorney must have the original document in their files for at least two years after the case closes. If you are not in the Kansas City, Missouri area these timelines may differ.

Remember that knowledge is power and the more knowledge you have about your bankruptcy petition the more power you will have in having your bankruptcy petition accepted.