By Rachel Lynn Foley, Esq.

June 23, 2012

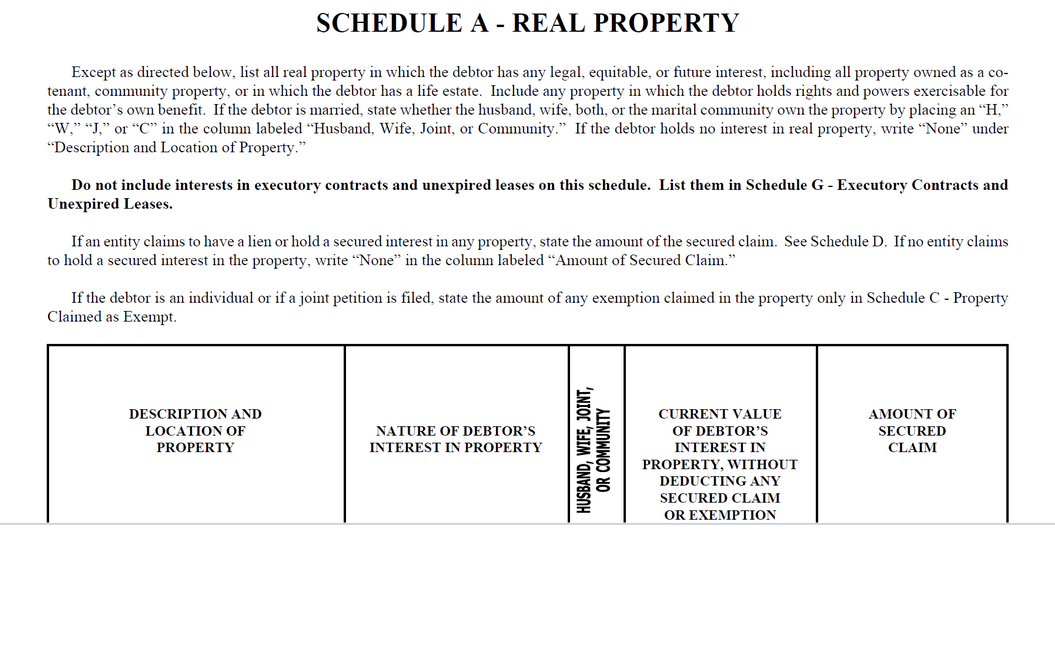

Schedule A - Bankruptcy Schedules

When you file bankruptcy...

you must fill out a Schedule A. We previously discussed thePetition and the next stop on our journey through the Bankruptcy Petition and Schedules is Schedule A. Schedule A is where you are going to list all of your real property. Real property? What is that? Do you mean to tell me that you can have real and fake property?In the bankruptcy arena the two most common terms when you describe property are real and personal property. Real property is land and anything that is tied to that land, such as your house. Think of real property as something that cannot be moved. Although the house might be able to be moved the land upon which it sits cannot. Personal property is stuff that can be moved. Car, boat, clothes, appliances, etc… When the house leaves the land and moves, I would argue that it then becomes personal property until such time as it becomes permanently affixed to land again. This scenario is more likely with mobile homes than a brick and mortar home but I have seen some these moved as well.

So for Schedule A you are going to list all the real property that you own. You must list it regardless if you owe money on it or not. You must list it regardless of how many owners are on it. You must list it whether you own land here or anywhere in the world. You even have to list any vacant lots that you own. If you intentionally fail to list all your real property you could be charged with perjury. This is not a chance you should be willing to take.

So how do you list the property? You are going to list the Nature of your Interest. Do you own the land by yourself? Yes, general warranty deed. Do you own it with a couple of people? Then it is probably joint tenants. Do you own it with your spouse? Then it maybe joint tenancy by the entirety. When in doubt find the deed to the property and look to see what your ownership interest is.

Next you want to provide a description of the property. I generally list out the address of the property and the legal description. The legal description will provide the exact location of the property. It will look something like this: Lot 121, Resurvey of Squirrel Meadows, a subdivision in Jackson County, Missouri. Also I provide any facts that I want the trustee and the judge to know about the property. Is the roof old and needs to be replaced? Is the siding falling apart? Would the home pass inspection if it were sold? Is the inside dated? Etc…. Why do you do this? Because you want the trustee to fairly and accurately make a decision about whether or not there maybe equity in the home.

For repairs that are needed to the home, what are the estimates needed for the repairs? This provides you information about what you need to get the repairs done and it also helps you to evaluate whether it is a good idea to keep the home or surrender it in bankruptcy. I have seen some cases where the repairs far exceed the value of the home. In those cases I am not so sure it is in your best interest to keep home without a convincing reason.

Keep in mind if you cannot exempt or protect your property it can be sold for the benefit of your creditors. Therefore you want to present an accurate picture of what the property, is worth. When determining the value of the property I look at several sources. I have my debtors drive their neighborhoods. What are the homes selling for? Not listing for but actually selling for. How long did the home sit on the market before it sold? I will also look at what the county values the home at as well as what Zillow values the home at.

Once all the information has been gathered we sit down to project a value of the home that we think is truthful, accurate and one I can support with evidence. It is crucial that you take an active interest in your case and gather as much information as you can about the value of your property. You failure to do so could result in you having to pay to keep the “alleged equity” in the home, losing the home or in the worst case scenario being charged with perjury for making a false statement to the court.

Remember that knowledge is power. The more knowledge you have about the value of the property the more power you will have to make an informed decision about whether you want to keep the property, or protect it with the exemptions by listing the value accurately and avoid being charged with perjury.